- Learn

- Invest

$50 to Help You Start Saving for College

The State of Illinois has launched a new program for all babies born or adopted on or after January 1, 2023 to a parent who is a resident of Illinois at the time of birth or adoption. Learn more about the program and the steps to claim the $50 seed deposit for your eligible child.

Explore how the Bright Start 529 plan can help you save for college.

With college costs on the rise, it’s essential to start saving early for your child’s education.

Learn how much to save for college, what a 529 college savings plan is, and how Bright Start can help you prepare to give your child a brighter future.

Gifting

One of the most meaningful gifts you can give a loved one is helping to put them on the path to a bright future with a college savings account. It’s easy for friends and family to make a contribution toward future education costs with Bright Start’s GiftED.

Make a Gift

Meet a few of the hundreds of thousands of families saving with Bright Start.

Start Quote

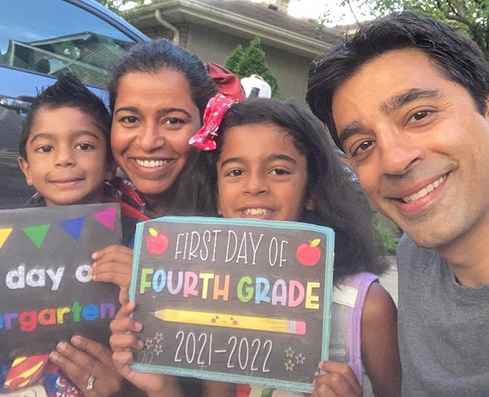

Start QuoteThink about saving for college while you have that time before your child is born. If it’s a month before, a week before — do it. No matter what.

End QuoteSagar Deo Contributing to Bright Start

Saving even a small amount each month is a great way to help cover future education costs. Consider contributing whatever you can, whenever you can. Every dollar saved helps reduce future student loan debt.

Learn About Contribution Options

How much will you save if you start now?

With our college savings calculator, use the amount you can afford to contribute each month and the child’s current age to estimate how much you’ll save by the time they’re ready for college.

More About the Cost of CollegeBright Start Is Here to Help You Learn.

Explore our resources to support your successful college savings journey.

With Bright Start, your savings can grow with your child and can be used for a variety of schools and higher education expenses. This Bright Start Study Hall video shows you why this 529 is a great way to save.

Looking for something specific?

Ready to open your account?

Enroll Today